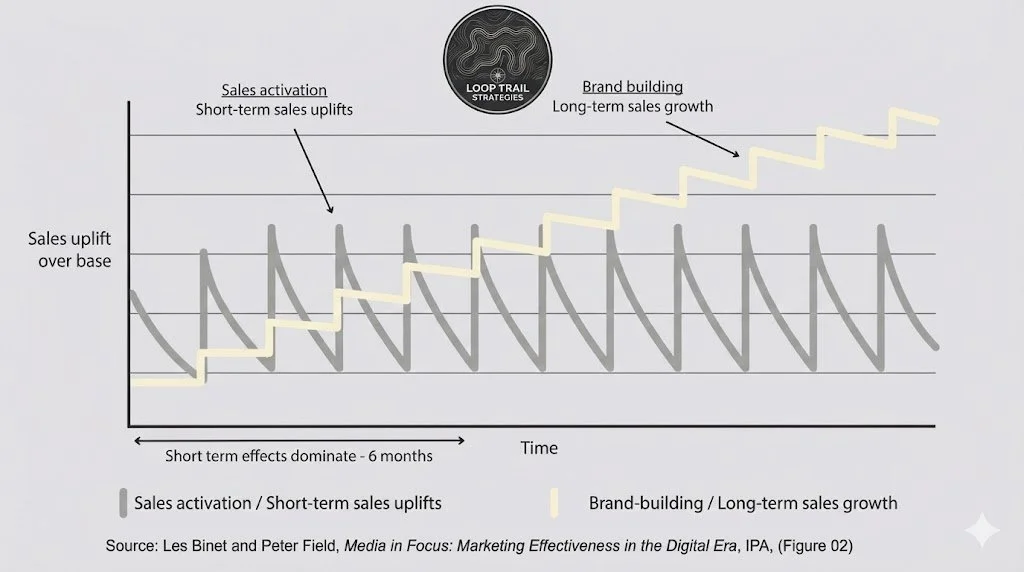

Do you want to “rent” revenue or invest in compounding brand equity?

We marketing leaders today are under relentless pressure to justify every dollar with short-term results. Leadership, Boards, and CFOs, convinced by years of brainwashing by the industrial digital advertising complex, want proof that marketing dollars are working. In many cases, they want to see the ROI the next day. Maybe you can talk them into a 7-day window. Or perhaps, you’ve really pushed the boat out and won the right to a 30-day attribution window (Wow! Nice work!). But regardless, almost all roads lead to performance marketing — with its measurable ROAS, real-time dashboards, and defensible budgets. Yet this obsession with the bottom of the funnel comes at a steep strategic cost: brands are hemorrhaging long-term equity while chasing immediate conversions.

Effectively, they are paying “rent” to Meta and Google to win short-term sales from new customers who almost always show a much lower propensity to repurchase and significantly lower CLV (customer lifetime value). But why pay “rent” when you “own”? Especially when rent keeps going up: the cost of acquiring a new customer on Meta and Google has increased by 60% over the last five years!

What do I mean by “own”? I mean investing dollars in growing equity - equity in your brand and in your customer relationship - such that revenue not only grows over time, but compounds as EVERYTHING gets more efficient!

Data shows that brands with high consumer awareness achieve 2.5× the conversion rates of low-awareness competitors across channels, yet 2.5× as many marketing leaders prioritize (or are forced to prioritize) performance over brand in their spend allocations.

The commercial logic for investing in brand is both simple and powerful. Established brands benefit from dramatically lower customer acquisition costs — 30–50% less CAC than unknown competitors — because recognition reduces friction and amplifies every marketing dollar. McKinsey research reinforces this: moving from low to moderate awareness can reduce CAC by an average of 35%, while strong brands generate 40–60% higher lifetime value and command pricing power that performance alone can’t deliver.

Let’s end the trope that brand is “soft” or intangible, or the fluffy stuff we’ll allocate smaller dollars to (but which will be first on the chopping block when things get tight) — it is a measurable driver that makes every downstream tactic more efficient and effective!

And to make matters worse, common attribution models give last-click credit to performance channels that merely harvested demand created by brand efforts — a phenomenon known as the “dark funnel.” This misattribution “proves” that performance works and forces more budget into search and social ads (either dynamically or from losing internal arguments) while starving the very activities that prime audiences to buy: awareness, trust, and preference.

Brand leaders should treat brand investment not as an optional luxury, but as a strategic foundation that will support and drive revenue for years to come through good times and bad. You just need to give it enough time to show up in the numbers. Patiences my friends. Patience.